If your AR balance is $60,000, but you only have $40,000 in invoices that are due, your net profit will be overstated and you’ll be paying taxes on income that you’ll never receive. No matter what you’re reconciling, it will involve comparing two sets of records to determine accuracy. Income tax liabilities are reconciled through a schedule to compare balances with the general ledger. For example, a company maintains a record of all the receipts for purchases made to make sure that the money incurred is going to the right avenues. When conducting a reconciliation at the end of the month, the accountant noticed that the company was charged ten times for a transaction that was not in the cash book. The accountant contacted the bank to get information on the mysterious transaction.

- Conversely, identify any charges appearing in the bank statement but that have not been captured in the internal cash register.

- To mitigate this confusion, teams should add a human in the loop for workflows like automated bank matching to manually review outputs for duplicate entries.

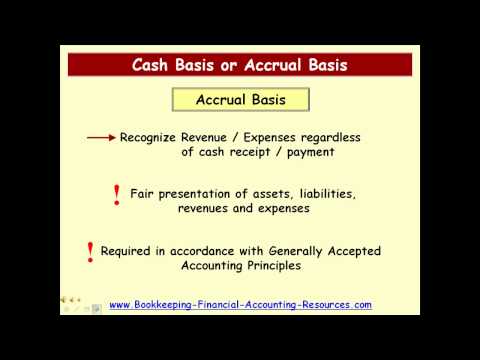

- Businesses use one of these two approaches to perform account reconciliation in various contexts.

- It makes sure that your customer account write-offs are correctly recorded against the Allowance for Doubtful Accounts and that discrepancies are addressed.

Reasons To Reconcile Bank Statements

In general, reconciling bank statements can help you identify any unusual transactions that might be caused by fraud or accounting errors. The analytics review approach can also reveal fraudulent activity or balance sheet errors. In this margin vs markup case, businesses estimate the amount that should be in the accounts based on previous account activity levels. Determine if they are due to timing differences, data entry errors, or potential fraud.

Automated reconciliation also flags discrepancies so they can be investigated immediately rather than months later. Schedule a demo to see how Numeric can streamline your recs for a faster and more accurate close. For teams on Numeric, a full audit trail of preparer, reviewers, comments, and action taken will automatically be stored.

How Account Reconciliation Works (Reconciliation Process)

The account reconciliation process also helps to identify any outstanding items that need to be taken into consideration in the reconciliation process. Bank reconciliations involve comparing the business’s financial statements with the statements it receives from the bank. This helps to ensure that the business’s records accurately reflect the transactions that have taken place in its bank how to get a bank statement account. This is because the general ledger is considered the master source of financial records for the business.

Common Errors in General Ledger Reconciliation

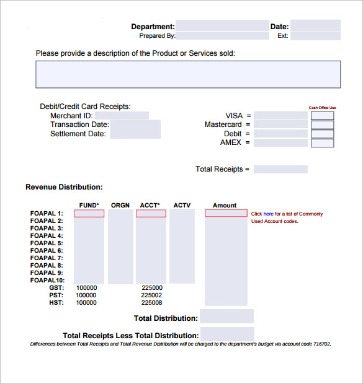

The balances between the two records must agree with each other, and any discrepancies should be explained in the account reconciliation statement. Regularly reconciling your accounts, especially bank accounts and credit card statements can also help you identify suspicious activity and investigate it immediately, rather than months after it has occurred. And if you never reconcile your accounts, chances are that fraudulent activity will continue. Reconciling credit cards involves comparing purchase receipts with credit card statements provided by the card company. This helps to ensure that all credit card transactions have been accurately recorded in the business’s financial records. Some businesses create a bank reconciliation statement to document that they regularly reconcile accounts.

Without these documents, reconciliation becomes guesswork, leading to potential errors. General ledger reconciliation is the process of comparing the balances in a company’s general ledger to supporting financial documents to ensure accuracy. There are several steps involved in the account reconciliation process, depending on the accounts that you’re reconciling. While reconciling your bank statement, you notice the bank debited your account twice for $2,000 in error. Incorporating these strategies into your reconciliation process not only simplifies the task but also enhances the accuracy and efficiency of your financial management. Integration with accounting software like NetSuite, QuickBooks, Xero, or Sage, especially when paired with Ramp, can be a significant step toward streamlining your financial operations.

Please contact an accountant, attorney, or financial advisor to obtain advice with respect to your business. Businesses use one of these two approaches to perform account reconciliation in various contexts. Account reconciliations are an essential part of financial management in any business. Nigel Sapp is a content marketer at Numeric, partnering with top accountants to break down best practices, thorny accounting topics, and helping teams navigate the world of accounting tech. Similarly, tasks should be properly delegated across team members to avoid overlapping duties. When numbers go awry, an avalanche of financial issues come in its wake meaning that reporting, invoice examples for every kind of business decision-making, and more are thrown into chaos.

Make a list of all transactions in the bank statement that are not supported, i.e., are not supported by any evidence, such as a payment receipt. The accountant of company ABC reviews the balance sheet and finds that the bookkeeper entered an extra zero at the end of its accounts payable by accident. The accountant adjusts the accounts payable to $4.8 million, which is the approximate amount of the estimated accounts payable. Reconciliation serves an important purpose for businesses and individuals in preventing accounting errors and reducing the possibility of fraud. Businesses and individuals may use account reconciliation daily, monthly, quarterly, or annually. By being aware of these common errors, you can implement strategies to avoid them and maintain accurate and reliable financial records.

Vendor reconciliations involve comparing the statements provided by vendors or suppliers with the business’s accounts payable ledger. This helps ensure that the company pays vendors and suppliers accurately and on time. It involves calling up the account detail in the statements and reviewing the appropriateness of each transaction. The documentation method determines if the amount captured in the account matches the actual amount spent by the company. Reconciliation ensures that accounting records are accurate, by detecting bookkeeping errors and fraudulent transactions. The differences may sometimes be acceptable due to the timing of payments and deposits, but any unexplained differences may point to potential theft or misuse of funds.